Need help?

Most frequently asked questions

Zrzutka.pl is a tool thanks to which you can create fundraisers for any purpose, in accordance with the law and the Portal's Regulations. The portal's operations are fully automated and user-friendly, allowing you to navigate its space easily and quickly - completely free of charge!

Anyone over the age of 13 can organise a drop. It is necessary to have a bank account maintained in the Republic of Poland - a personal account is used to verify the account.

You can organise a dropshot for any purpose that complies with the law and the Portal's Terms and Conditions.

Get inspired by watching this video animation! Want to make sure your dropshot goal is legal? Check out our article describing the prohibited purposes of airdrops.

Basically, profile verification consists of three steps - filling in the identification form, performing a verification transfer and uploading the relevant documents.

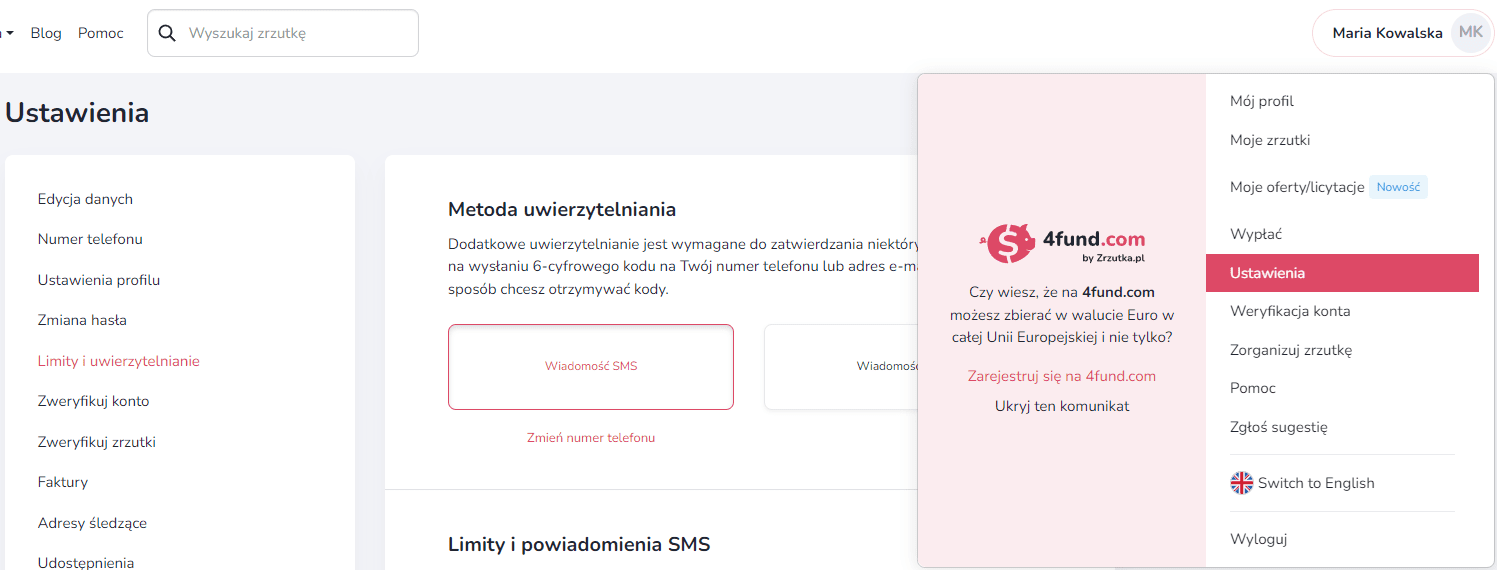

To complete the verification, select "Account verification" from the drop-down menu at the top right of the page.

In the first step you will be asked to select your account type.

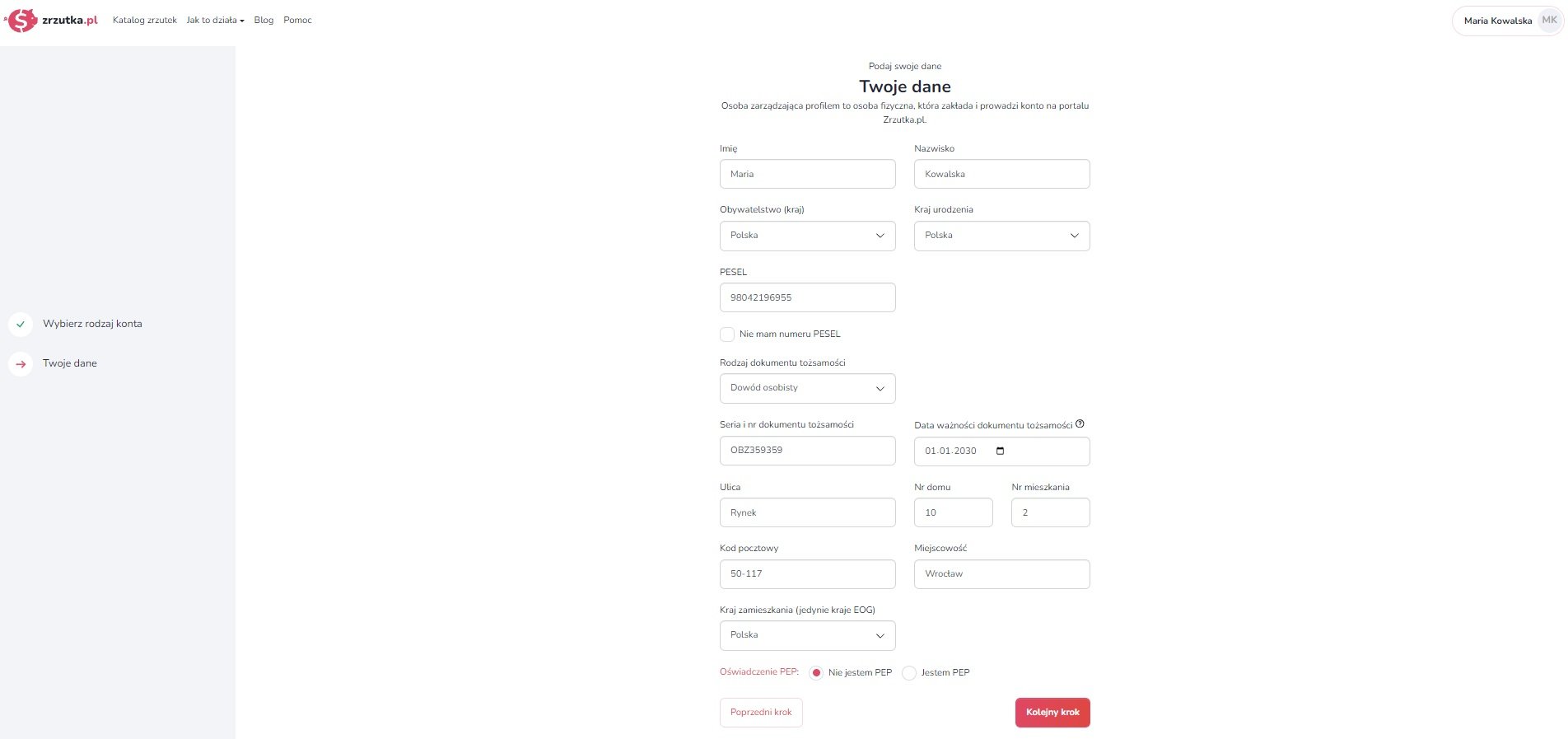

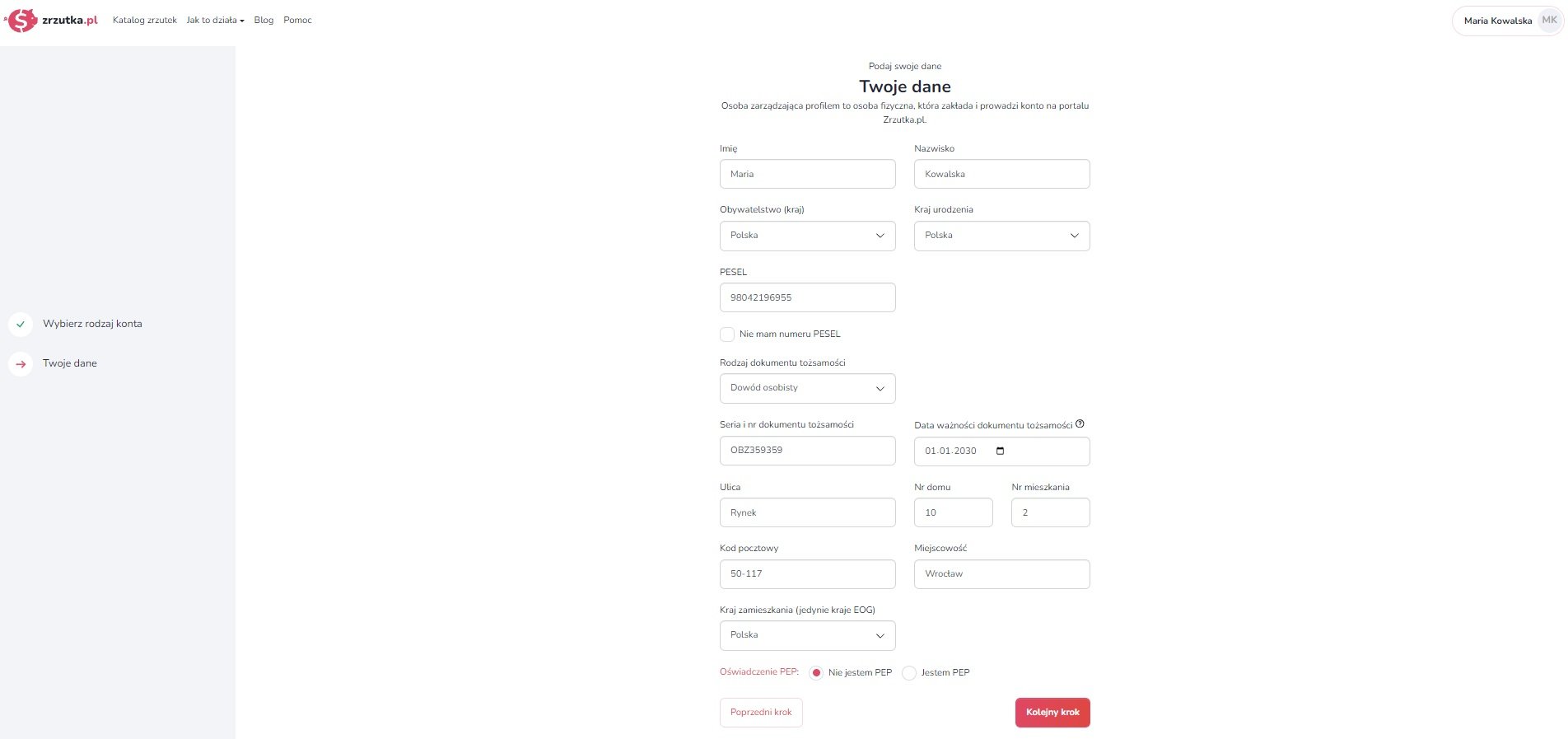

In the next step, you will be presented with an identification form where you will be asked to provide basic details such as your name, PESEL number, residential address or the number and expiry date of your identity document.

Important - remember to enter the actual data in the form, as once the form is saved you will be asked to verify it and it will no longer be possible to edit it.

Once you have completed the form and clicked on "Next step", you will still see the PEP statement, i.e. about (not) holding a politically exposed position.

In the next step, we will once again summarise the data you have completed. Read them carefully and make sure that they do not contain any errors - once the form is saved, editing the data will no longer be possible.

Once you have saved your data, your droplet is automatically activated for a period of 30 days, during which time you will need to complete account verification. In order to also be able to make withdrawals and continue with the airdrop, it is still necessary to make a verification transfer and to send the relevant documents.

How do I make a verification transfer?

You need to make a verification transfer by transferring £1 from your own bank account, to the individual account number of the airdrop you set up earlier. You can do this in two ways - with a standard or instant verification transfer.

All the data you need to make a standard verification transfer can be found in the "verification" tab. All you need to do is copy them and order the transfer on your bank's website. The bank account from which you make the verification transfer will later be the only one to which you can withdraw the collected funds.

Please note that the details given below are only an example. Each user has individual data for making a verification transfer - you will find them in the "verification" tab.

Remember: the name and surname of the sender of the transfer (or the name of the company in the case of a company profile) must be identical to the data you have provided in the form (to be checked in the "Your saved data" tab). If these details do not match, the verification will be rejected. It must be a regular, traditional transfer made through the website of your Polish bank - the verification payment cannot be made from abroad, through external payment gateways or through the 'deposit' button on the dropshot page.

You can also choose a faster and easier option - an instant verification transfer. All you have to do is select the appropriate bank from the list, log in to your banking and order the transfer, and your account will be verified even in a few minutes! Please note - this option is only available for selected banks.

How do I attach documents to verify my profile?

The final verification step is to attach the relevant verification documents. For verification of your private account, you only need to send us scans/photos of your identity document - ID card, passport or residence card. You can send the documents for automatic verification (usually takes up to 5 minutes) or traditional verification (takes up to 48 hours). Automatic verification can only be used by natural persons of legal age who are not in a politically exposed position (not PEPs).

The data from the documents submitted must match the data sent in the identification form and verification transfer. Also ensure that the attached photographs are of good quality and that none of the edges of the document are cropped. We will proceed to verify the attached documents as soon as the verification transfer is credited to your dropbox account, and we will send you information about the verification status via email.

Check also - how do I verify my company/organisation account?

We are committed to the highest safety standards. Find out more at https://zrzutka.pl/bezpieczenstwo/.

Basically, profile verification consists of three steps - filling in an identification form, making a verification transfer and attaching the relevant documents.

To complete the verification, select 'Account Verification' from the drop-down menu at the top right of the page.

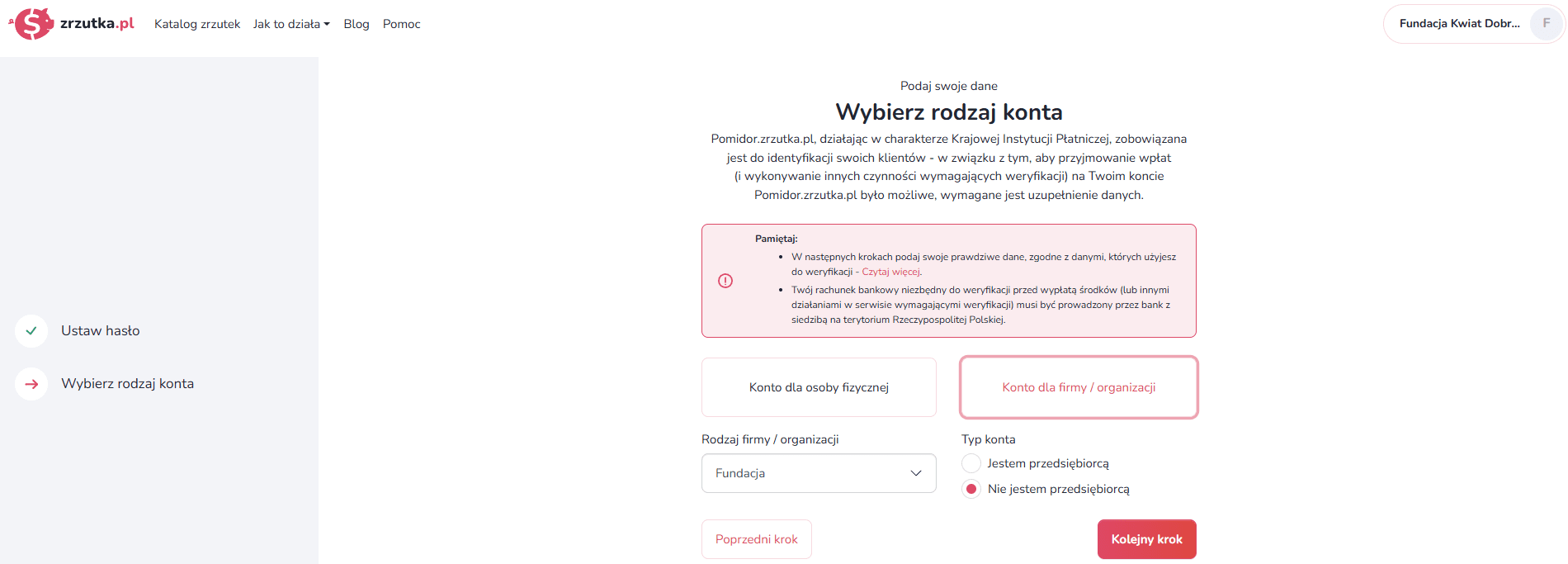

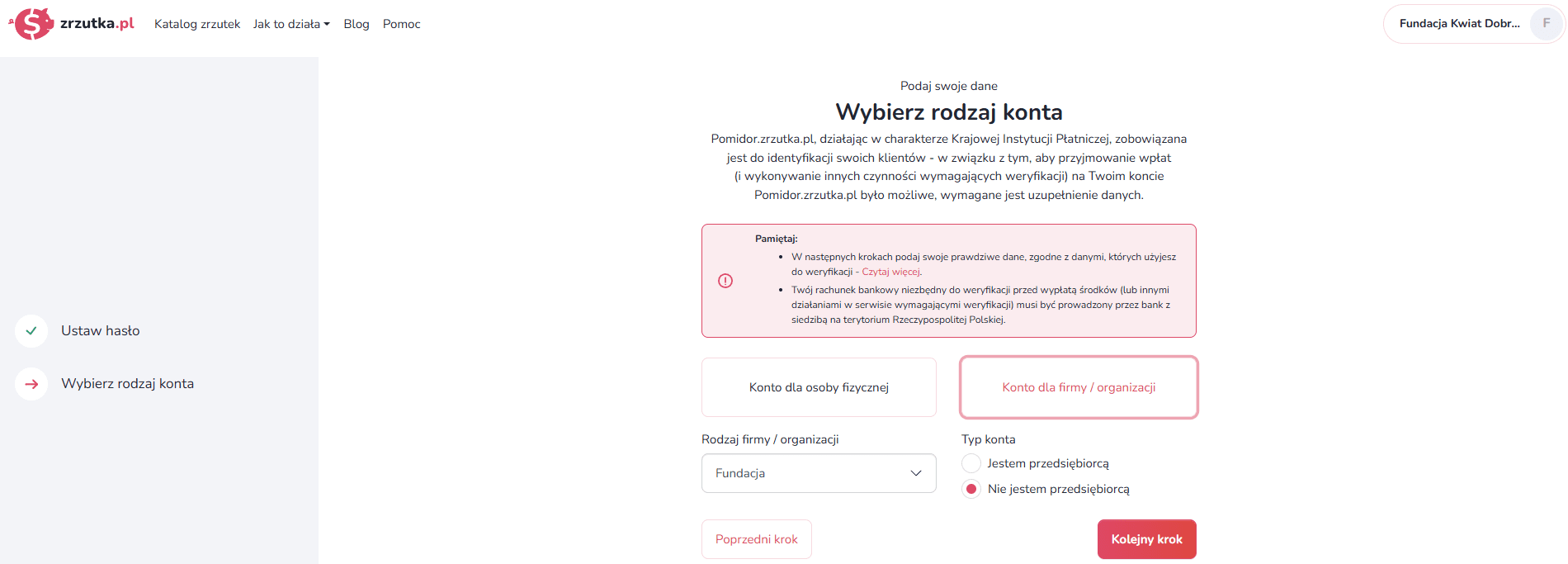

In the first step, you will be asked to select the account type, the type of company/organisation, e.g. Foundation, and the account type relating to the entrepreneur:

Next, an identification form will appear in the window where we ask you to enter the details of the person who manages the profile, i.e. the one who will actually log in to our portal and manage the collections set up. The form should contain basic data, i.e. first and last name, PESEL number, address of residence or number and expiry date of an identity document.

Important - remember to enter the actual data in the form, as once the form is saved you will be asked to verify it and it will no longer be possible to edit it.

The next two steps vary depending on which legal form your business is in. First, we will ask you to provide the details of the entity, i.e. the TIN and the address of its registered office. In the case of Foundations, Registered Associations, Co-operatives and Companies (except for a civil partnership), you will also need to enter the KRS number.

Further on, it will be necessary to enter the details of the Beneficiaries Actual of the entity you represent, which we need to establish in accordance with the Anti-Money Laundering and Countering the Financing of Terrorism Act. The Beneficial Beneficiaries are, in simple terms, the natural persons who actually exercise authority over the entity in question, exercising control over it directly or indirectly. They are required to indicate the details of their Beneficial Beneficiaries: Foundations, Registered Associations, Co-operatives, Limited Liability Companies, General Partnerships, Partnerships, Joint Stock Companies (except public companies), Simple Joint Stock Companies, Limited Partnerships and Limited Joint Stock Companies. These entities are also obliged to make a relevant entry in the Central Register of Beneficial Owners, which must be sent together with other documents for profile verification.

However, this obligation does not apply to Ordinary Associations, Civil Partnerships, Sole Proprietorships or other institutions such as churches or sports clubs.

If your organisation has not yet been notified to the CRBR, please refer to these articles on the gov.pl and ngo.pl portals.

In the next step we will summarise the data you have completed once again. Check them carefully and make sure they do not contain any errors - once the form is saved, editing the data will no longer be possible.

Once your details have been saved, your droplet becomes active for a period of 30 days and you can now make payments to it. In order to be able to also make withdrawals and keep your donations active permanently, it is still necessary to make a verification transfer and to send the relevant documents.

How do I make a verification transfer?

A verification transfer involves sending the amount of PLN 1 from your company/organisation's bank account to the individual account number of the dropshot you set up earlier. You can make it in two ways - with a standard or instant verification transfer.

All the data you need to make a standard verification transfer, you will find in the "verification" tab. Simply copy them and order the transfer on your bank's website. The bank account from which you make the verification transfer will later be the only one to which you can withdraw the collected funds.

Please note that the details given below are only an example. Each user has individual data for making a verification transfer - you will find them in the "verification" tab.

Remember! The name of the sender of the transfer must be identical to the data of the company/organisation which was provided earlier in the form (to be checked in the "Your saved data" tab). If these details do not match, the verification will be rejected.

The standard verification transfer must be a regular, traditional transfer made through the website of your bank based in Poland - the verification payment cannot be made from abroad, through external payment gateways or through the 'deposit' button on the dropbox page.

You can also choose a faster and easier option - an instant verification transfer. All you have to do is select the appropriate bank from the list, log in to your banking and order the transfer, and your account will be verified even in a few minutes! Please note - this option is only available for selected banks.

How do I attach documents to verify my profile?

The final verification step is to attach the relevant verification documents. Here again, there will be a difference - depending on what type of business you do, the system will ask you to attach the relevant documents. You can find a detailed breakdown of the required documents here.

The data from the uploaded documents must match the data indicated in the identification form and verification transfer. Please also ensure that the photos you attach are of good quality and that all edges of the document are visible.

We will proceed to check the verification documents as soon as the verification transfer is credited to your dropbox account. You will be notified by email in case of any deficiencies. Once the attached files are accepted by our Security Department, your account will already be indefinitely active and the possibility to withdraw the collected funds will be unlocked.

Check also - how to verify a private account?

This article is dedicated to the safe use of zrzutka.pl. Find out that using zrzutka.pl safely is not difficult at all - in this article you will find everything you need!

Verification of organiser profile

Basically, profile verification consists of three steps - filling in the identification form, performing a verification transfer and uploading the relevant documents.

To complete the verification, select "Account verification" from the drop-down menu at the top right of the page.

In the first step you will be asked to select your account type.

In the next step, you will be presented with an identification form where you will be asked to provide basic details such as your name, PESEL number, residential address or the number and expiry date of your identity document.

Important - remember to enter the actual data in the form, as once the form is saved you will be asked to verify it and it will no longer be possible to edit it.

Once you have completed the form and clicked on "Next step", you will still see the PEP statement, i.e. about (not) holding a politically exposed position.

In the next step, we will once again summarise the data you have completed. Read them carefully and make sure that they do not contain any errors - once the form is saved, editing the data will no longer be possible.

Once you have saved your data, your droplet is automatically activated for a period of 30 days, during which time you will need to complete account verification. In order to also be able to make withdrawals and continue with the airdrop, it is still necessary to make a verification transfer and to send the relevant documents.

How do I make a verification transfer?

You need to make a verification transfer by transferring £1 from your own bank account, to the individual account number of the airdrop you set up earlier. You can do this in two ways - with a standard or instant verification transfer.

All the data you need to make a standard verification transfer can be found in the "verification" tab. All you need to do is copy them and order the transfer on your bank's website. The bank account from which you make the verification transfer will later be the only one to which you can withdraw the collected funds.

Please note that the details given below are only an example. Each user has individual data for making a verification transfer - you will find them in the "verification" tab.

Remember: the name and surname of the sender of the transfer (or the name of the company in the case of a company profile) must be identical to the data you have provided in the form (to be checked in the "Your saved data" tab). If these details do not match, the verification will be rejected. It must be a regular, traditional transfer made through the website of your Polish bank - the verification payment cannot be made from abroad, through external payment gateways or through the 'deposit' button on the dropshot page.

You can also choose a faster and easier option - an instant verification transfer. All you have to do is select the appropriate bank from the list, log in to your banking and order the transfer, and your account will be verified even in a few minutes! Please note - this option is only available for selected banks.

How do I attach documents to verify my profile?

The final verification step is to attach the relevant verification documents. For verification of your private account, you only need to send us scans/photos of your identity document - ID card, passport or residence card. You can send the documents for automatic verification (usually takes up to 5 minutes) or traditional verification (takes up to 48 hours). Automatic verification can only be used by natural persons of legal age who are not in a politically exposed position (not PEPs).

The data from the documents submitted must match the data sent in the identification form and verification transfer. Also ensure that the attached photographs are of good quality and that none of the edges of the document are cropped. We will proceed to verify the attached documents as soon as the verification transfer is credited to your dropbox account, and we will send you information about the verification status via email.

Check also - how do I verify my company/organisation account?

Filling in the identification form is necessary before accepting the first payment for the drop. On the other hand, verification by bank transfer and identity document must be done before the first payment, but no later than 30 days after completing the identification form.

If you do not confirm the veracity of your details within this time, your account will be deleted after 30 days and the funds collected returned to the supporters.

In order to verify the profile, it is necessary to send a scan or a photo of the identity document of the profile owner - this may be an identity card, passport, residence card or school ID card (in the case of minors).

Your data is secure with us - documents added using the form are attached using an encrypted connection (256-bit GeoTrust certificate). By providing us with a copy of your ID card during verification, you can additionally obscure some of your data.

Only the following data must be visible:

It is also acceptable to include a note on scans/photographs of identity documents:"Document valid only for the purpose of account verification on zrzutka.co.uk".

If you are an individual, it is necessary to send a scan/photo of your identity document: identity card (both sides), passport (photo side), residence card (both sides) or school ID card (both sides). The details from the document must match the details of the account from which the transfer was sent.

Your data is safe with us - you can read more about this here. In order to keep your data as secure as possible, you can additionally write on your scans/photos: "Document valid only for the purpose of account verification on zrzutka.pl" and blur all unnecessary fields in such a way that your address, citizenship, identity document number, PESEL, expiry date and name (both sides) are still visible - see example.

If you are setting up a profile on behalf of a company/organisation/foundation, the type of documents required will vary depending on the form of your business. You can find a full list of required documents here.

A standard verification transfer can take up to 2 working days to post. If it takes longer and you do not get any error message from us, it is most likely that additional characters not mentioned in the "Account verification" tab have been entered in the title of the transfer, e.g. the word "verification" or anything else has been added in addition to the string you enter. Additional characters prevent our system from posting the transfer.

If such a mistake has been made , please make the verification transfer again with a correct title. After a correctly executed verification transfer has been credited, you will be able to withdraw the 'old' and 'new' PLN paid in verification - the verification transfer is not a fee! Also make sure that the transfer is made from your Polish account.

The transfer cannot be made through an intermediary (e.g. post office, Blue Media, Bluecash, SORBNET) - in case of using an intermediary we do not receive your account number so we cannot accept such verification.

In summary - a standard verification transfer:

- MUST be made from your Polish bank account as instructed,

- it MUST be accompanied by a verification code defined by us in the "Account Verification" tab (without any additional characters)

- It MUSTNOT be made using the intermediaries listed above (as well as any other).

If you have made a mistake while making the verification transfer, please make the transfer again - correctly. Once a correctly executed verification transfer has been credited, both deposited PLN will be available for withdrawal.

Remember, you can also make an instant transfer and shorten the verification time to just a few minutes!

In order to verify the profile, it is necessary to have a bank account maintained in the Republic of Poland. Therefore, it is unfortunately not possible to verify by means of a transfer from a foreign account(including a Revolut account).

The posting of a standard verification transfer depends solely on the bank and usually takes up to two working days. You can also use the instant transfer option, which reduces the verification time to several minutes.

On the other hand, we will check the attached verification documents as soon as they are sent (but only after the verification transfer has been credited). Our customer service representatives work on verification every day between 7:00 a.m. and 9:00 p.m. If there are any deficiencies or problems with verification, you will be informed by email.

The codes are automatic messages. Each code is only valid for 5 minutes after it has been generated in our system, so if this time has already expired, you must repeat the action on our website and generate a new code. In addition, each time a code is generated, the previously submitted code is deactivated. Therefore, if verification attempts have been made several times, please ensure that the code you enter is from the last message received.

If you receive codes in an e-mail message, check all your mail folders carefully in the first instance - including your SPAM folder. Also make sure that your mailbox is not overflowing. If you find a message with a code in the SPAM folder, mark it as a safe message so that the problem does not occur again in the future.

It also happens that some mail servers queue messages to free accounts, so they come with a certain delay (especially on Onet and Interia). This in turn causes our verification codes to become deactivated. In such a situation, we suggest changing the authorisation method to SMS.

The authorisation method can be changed in the "Settings" tab -> "Limits and authentication" -> "Authentication method" -> "SMS message" (alternatively, if you have problems receiving codes sent in SMS - change the authorisation method to e-mail).

A PEP is a politically exposed person (i.e. minister, MP, senator, etc.). As a National Payment Institution, we are required to confirm the identity of our users and identify PEPs when setting up an account, which is why the PEP status question is on your account data form. If you are unsure which option to tick, please check the full list of those considered to be PEPs.

If this is the case, please contact our customer service at [email protected] so that editing is unlocked and you can correct your answer on the form.

General

Zrzutka.pl is a tool thanks to which you can create fundraisers for any purpose, in accordance with the law and the Portal's Regulations. The portal's operations are fully automated and user-friendly, allowing you to navigate its space easily and quickly - completely free of charge!

Anyone over the age of 13 can organise a drop. It is necessary to have a bank account maintained in the Republic of Poland - a personal account is used to verify the account.

You can organise a dropshot for any purpose that complies with the law and the Portal's Terms and Conditions.

Get inspired by watching this video animation! Want to make sure your dropshot goal is legal? Check out our article describing the prohibited purposes of airdrops.

Setting up the drop

At zrzutka.co.uk you will set up your own dropbox in no time! All you need to do is fill out the simple form available on our homepage. Then our system will guide you step by step - you will add a title, a photo and a description. In just a few minutes, your droplet will be ready to share and accept donations!

We also encourage you to take a look at our "How does it work?" tutorial (click), where we described the first steps on zrzutka.co.uk, as well as the instructions for editing your airdrop.

The title of your dropbox, which is the phrase you type in the 'target' field, is the second most important place (right after the photo) that catches the eye of your audience. This is why it is so important to think it through. The rules for creating good headlines are trivial:

Good tip: To create an original headline, you can experiment with its form. We have some inspiration for you:

Think about what verbs do dropshipping organisers use most often? Try to exclude words like "help" or "support" and use less obvious ones. If they are related to the purpose of your droplet, even better!

Replace: Help us go to the competition with: Win a gold medal with us!

Use a hashtag, which is a single word or a cluster of several words written directly after the # sign. It's a great way to communicate on social media - use a hashtag when sharing your drop - draw attention to yourself and make yourself easy to find! Examples: #Julka'sHeart, #MartynavsEndometriosis, #WeRiseFromWheelchair, #TeamGosia

Or maybe you like nursery rhymes? Just not necessarily whole sonnets straight away - short forms rule in headlines. You can use a discreet rhyme and make the title of your drop a memorable one - for example, "Azor asks you, give him a penny", "Kops a zloty for a motorboat" or "Drop a fiver and let's chase cancer".

How most people who use Facebook read can be very easily observed by going into the comments section under the link to any article - most of the discussion revolves around the headline itself. Some of you may now be clutching your head and some of you may be smiling under your breath, recalling your own rash statements. Whichever group you belong to - you need to empathise with the people commenting on the text after seeing the headline itself! In fact, you have to encourage them to click and ensure that they don't run away, bored by the lengthy story. You can get the magic clicks with pictures and headlines - but what can you do to get people to donate rather than leave?

Take care with spelling and punctuation. A cliché? Then try to read the text carefully and don't get tired, remember the most important information and get some enjoyment out of it. Is it hard? Then don't do it to your audience!

First paragraph = first impression, plus many people won't have time to read on. This part of the text must be a masterpiece! It must grab the heart, make it interesting and make the reader reach for their wallet. This is the moment to reveal your strongest cards.

Beware of the wall of text like a fire! Even a keen bookworm will be discouraged by the sheer volume of content that is not divided into paragraphs or subsections. If you don't want to overwhelm your audience, break up the text into smaller chunks. This small change will make one very long piece of content naturally separate and easy to digest.

Opt for multimedia! Intersperse your description with pictures, videos, graphics... you are only limited by your imagination! Reading from picture to picture is easier and more enjoyable for the recipient than absorbing a long text all at once. And there is always the chance that he or she will stop by to read just a piece, but it will interest him or her, so he or she will read the next and the next....

And most importantly - tell the truth. Ultimately, only the truth will defend itself. Your screenshot will be seen by both strangers and acquaintances. The latter will be able to catch the odd inaccuracy very quickly. They will then let us know, and if our security department catches you lying, they will be forced to terminate your dropshot.

A good tip: if the above tips seem complicated to you, try to empathise with the person browsing Facebook. Imagine you're sitting down in a chair after a hard day at work, and an interesting throwback is displayed on your wall. A good photo and a catchy headline make you click... What will you pay attention to in the first place? What will make you not close the link, but keep reading? What will interest you more - graphics, videos or text?

There is no need to do so. The most important thing is to present it on your dropbox in the most factual and attractive way possible.

Setting up a dropbox and making your dreams come true is always a great idea! But to collect effectively, you need to get into the mindset of people browsing social media. The most common channels for promoting airdrops are Facebook, Instagram, X or TikTok. These are platforms that make effective use of videos and photos to attract attention, thus replacing an elaborate description with multimedia and short headlines. So when creating your droplet, think - what would grab your attention? Does your screenshot encourage people to click? In the following paragraphs, we will try to expand on this thought and inspire you to create content that gets clicks!

The main rule of social networks is brutally simple: first we see the picture, then we glance at the headline, at the very end we read the text. The graphic acts as bait - if someone is to catch the hook and click the dropdown, they must be encouraged to do so. By leaving the droplet without a photo, you doom yourself to failure!

To take a good photo, all you need is your mobile phone, a little imagination and the tips in our photography guide. We won't repeat them here, but we will add some useful information.

When you share a link to a throwback on social media, social media users will see a preview of the throwback, including a photo and title. Check out how the dropshot posts look on our Facebook and X-e - yours will be very similar. Note that the most visible element is the main photo of the screenshot. Therefore, it needs to display correctly, be well cropped and eye-catching. If your photo is dark, blurry, and the silhouette of the model (for example, the beneficiary) is cropped or barely visible - no one will click on the link and know your story!

Good tip: Once you've added your photo to the dropbox, share it on your Facebook wall and see what the preview looks like. If the photo is cropped incorrectly - crop it again! The work you put in now to improve the look of your dropbox will pay off in future contributions!

The cover of your droplet doesn't have to be a photo - you can also use a video. You can only include the video in your droplet's gallery via an external link - it's not possible to upload it directly to zrzutka.co.uk. To place a video in your droplet's gallery, upload it to any external portal (e.g. Youtube) and use the "Add link with video" option.

Remember that in this case, the thumbnail of the video will be displayed in the dropshot directory and on social media, without the play sign! Youtube allows you to upload your own thumbnail or use a random frame from the video for this purpose.

Good tip: Just because zrzutka.co.uk doesn't display a play button in the video preview doesn't mean you can't put it on your thumbnail. Place the appropriate symbol on your thumbnail using any graphics editor and check the effects!

Below you will find documents - templates of powers of attorney and consents that may be useful when using zrzutka.pl:

- Consent to run the droplet on my behalf and to process my medical documents - download in Polish, download in English

- Consent for the organisation to carry out the droplet on my behalf and to process my medical documents - download in Polish

- Consent to the processing of my medical documents - download in Polish

- Consent to carry out airdrops for the benefit of my mentee and to process my mentee's medical documents - download in Polish, download in English

- Consent to running a drop-off by an organisation on behalf of my mentee and processing medical documents of my mentee - download in Polish

- Consent to carry out airdrops for my benefit - download in Polish, download in English

- Consent to carry out a fundraising campaign on my behalf by the organisation - download in Polish

- Zgoda na prowadzenie zrzutki na rzecz mojej podopienego - download in Polish, download in English

- Consent of a parent/guardian to the running of a user account by a minor - download in Polish, download in English

- Power of attorney to manage the profile on zrzutka.pl for an employee of the company/foundation/association/other organisation - download in Polish, download in English

- Declaration about being a PeP - download in Polish, download in English

- Declaration on being a PeP (actual beneficiary) - download in Polish

- Declaration on sources of assets - download in Polish

- Zgoda na prowadzenie zrzutki na rzecz instytucji - download in Polish, download in English

- Consent to carry out the drop-off by an organisation for the benefit of another organisation - download in Polish

Edit drop

How does editing a droplet work?

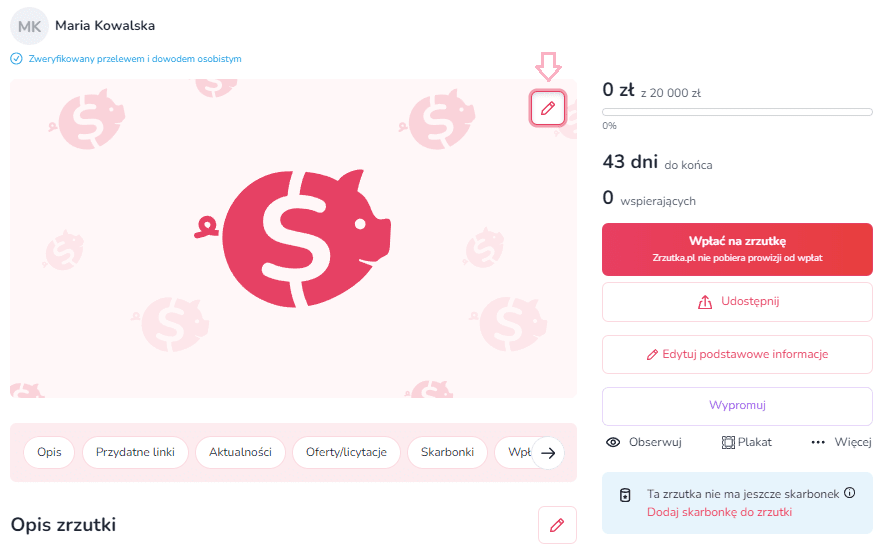

As an organiser, you have many possibilities to edit your airdrop.

IMPORTANT: Remember, however, that the editing option will be disabled once your droplet has been verified and/or promoted.

You can add just the basics, such as target amount, photo and description, or you can expand it a bit more by adding location, news, offers/auctions and posts for offers/auctions. Visitors to your droplet also have the option to create their own piggy bank to further support your goal.

You will find all settings related to the above mentioned functionalities in the droplet view.

As an Organiser, you see your airdrop slightly differently than other users - including all the editing options (these are marked with a pencil or cogwheel icon). We have described each of the editing options in more detail in separate sections. Click to find out exactly how to edit:

Remember - all editing options are visible only after logging in to the organiser's account for a particular droplet!

_____________

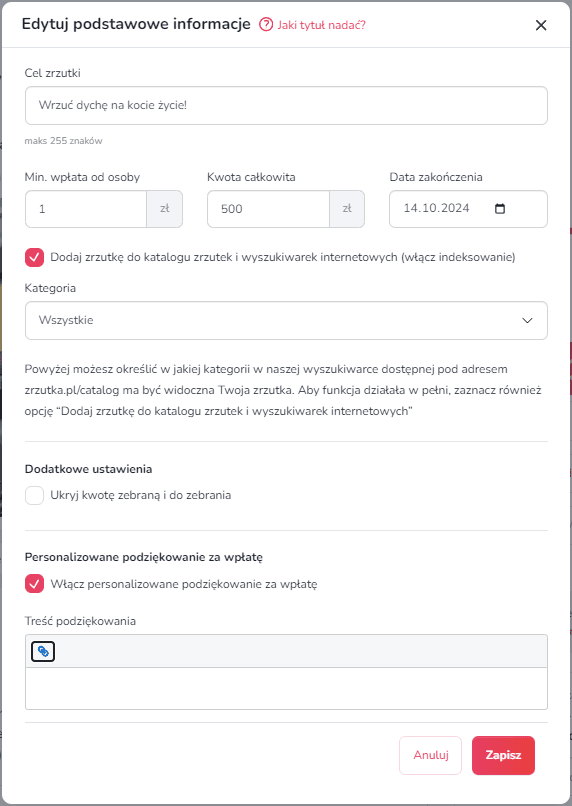

How do I edit basic information about my droplet?

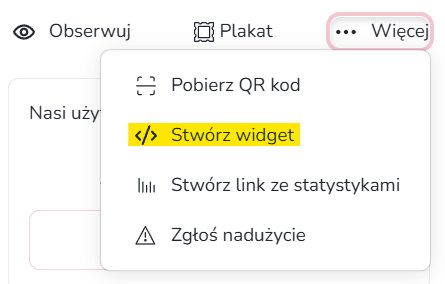

When you visit your droplet page after logging in, you will see the "Edit basic information" button to the right of the photo.

Underneath it you can edit the following details:

The purpose of the droplet, i.e. its title. In this section you need to enter the headline that will be visible in the catalogue and preview. The purpose should be short and catchy - the exact description of what the money is being raised for should be included in the description of the droplet.

A minimum donation per person, i.e. an amount below which donations to your droplet will not be accepted.

The total amount, i.e. the amount you wish to raise. The total amount can also be hidden for contributors - just tick the checkbox.

The end date of the droplet - by default this is set to 90 days, but you can change it at any time.

The possibility to check the "Add the airdrop to the airdrop directory and search engines"wantbox. - this will allow it to be displayed in our directory and in search engines such as Google.

Category, which is the tab of our directory where you want your droplet to be displayed.

Acknowledgements for contributors - by ticking the relevant box, a field will expand where you can enter your own thank you text which will be displayed to each donor after they have made a donation to your droplet. You can also add a link (e.g. to a YouTube video or photo gallery) to your thank-you text - select the text you want to link to and click on the icon in the top left-hand corner of the text box.

When you have finished editing, click "Save" to save the changes.

_____________

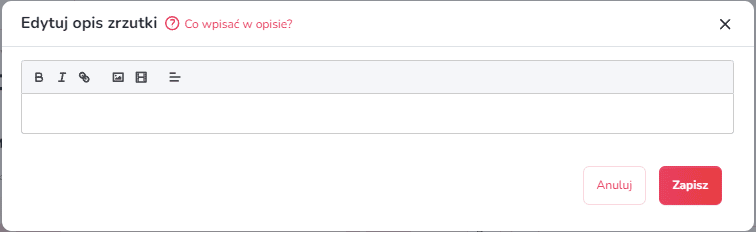

How do I edit my dropdown description?

To edit the description of your droplet, after logging in, click the pencil icon visible in the top right corner of the description box.

In addition to text, you can include photos (picture icon) or videos (filmstrip icon) in your description. Clicking on the icon with the letter B will bold the highlighted text. Looking further to the right is an icon for adding a hyperlink, i.e. a link that will open when the selected text is clicked.

And what to write about in the description? First of all, say explicitly what you need and what your story is, and explain exactly what the money raised will be spent on.

However, you must remember that the vast majority of the population are visual learners. More attention will be attracted by colourful pictures than by a wall of text. Try to keep the text short and concise to describe the cause and your situation. Don't go into detail - it may be important for you to write everything that is on your mind, but take our word for it - recipients do not like long texts. To make sure your text reads well, also take care with spelling, punctuation and the use of paragraphs.

When you have finished editing, click 'Save' to save your changes.

Yes. The organiser creates the droplet on their own, including its description.

If you want to organise your own airdrop, please check how the edit airdrop works.

If your droplet does not yet have any photos, add them by clicking on the pencil icon:

If, on the other hand, you want to add more photos to a droplet that already has media - also click on the pencil icon in the top right corner of the photo you have already added.

When adding a photo, a menu will expand where you can upload a photo from your computer or add the URL of a video to be displayed in the droplet gallery. You can also use the sample graphics from the 'Select Cover' tab.

A good photo should be min. 750 x 420 px. When adding a photo, you can rotate it accordingly and also crop it using the slider to make it look as good as possible on the screenshot.

Here you can also change the order of the media in the gallery by moving them around. The first photo or video will be displayed in the preview of your screenshot.

When you have finished editing, click 'Save' to save your changes. And if you want to know more about how to take an eye-catching photo - take a look at our blog.

You will find the list of contributions in the view of your dropbox just below the piggy banks.

Here, you can easily change the way your donations are sorted - from the most recent or from the highest donation. In addition, by clicking on the cogwheel, you also have the option to hide the amounts or details of all your donations, as well as to allow recurring donations (provided your profile has already been fully verified).

You can edit your airdrop target amount in the "Edit basic information" section of your airdrop page.

In case the description of your airdrop has already been verified and its editing has been blocked, in order to increase your airdrop target please contact our customer service.

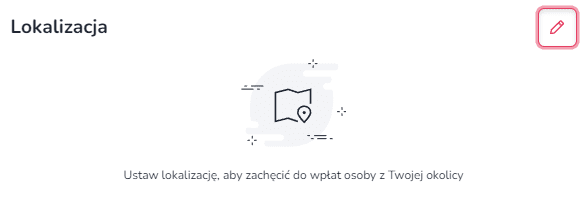

If you want to add a location to your droplet (e.g. so that supporters know where you are and if you are a person from their area), you will do so by clicking the pencil icon located in the 'location' section under the droplet description.

You can either type the location into the search bar, or mark it on the map with a pin.

When you have finished editing, click 'Save' to save your changes. The location will appear in the dropdown view as follows:

When you click on "View on map", a window will open with the location and the option "Route":

Interested parties can find your droplet by its location in the droplet catalogue using the search by location.

Verification of the organisation's profile

Basically, profile verification consists of three steps - filling in an identification form, making a verification transfer and attaching the relevant documents.

To complete the verification, select 'Account Verification' from the drop-down menu at the top right of the page.

In the first step, you will be asked to select the account type, the type of company/organisation, e.g. Foundation, and the account type relating to the entrepreneur:

Next, an identification form will appear in the window where we ask you to enter the details of the person who manages the profile, i.e. the one who will actually log in to our portal and manage the collections set up. The form should contain basic data, i.e. first and last name, PESEL number, address of residence or number and expiry date of an identity document.

Important - remember to enter the actual data in the form, as once the form is saved you will be asked to verify it and it will no longer be possible to edit it.

The next two steps vary depending on which legal form your business is in. First, we will ask you to provide the details of the entity, i.e. the TIN and the address of its registered office. In the case of Foundations, Registered Associations, Co-operatives and Companies (except for a civil partnership), you will also need to enter the KRS number.

Further on, it will be necessary to enter the details of the Beneficiaries Actual of the entity you represent, which we need to establish in accordance with the Anti-Money Laundering and Countering the Financing of Terrorism Act. The Beneficial Beneficiaries are, in simple terms, the natural persons who actually exercise authority over the entity in question, exercising control over it directly or indirectly. They are required to indicate the details of their Beneficial Beneficiaries: Foundations, Registered Associations, Co-operatives, Limited Liability Companies, General Partnerships, Partnerships, Joint Stock Companies (except public companies), Simple Joint Stock Companies, Limited Partnerships and Limited Joint Stock Companies. These entities are also obliged to make a relevant entry in the Central Register of Beneficial Owners, which must be sent together with other documents for profile verification.

However, this obligation does not apply to Ordinary Associations, Civil Partnerships, Sole Proprietorships or other institutions such as churches or sports clubs.

If your organisation has not yet been notified to the CRBR, please refer to these articles on the gov.pl and ngo.pl portals.

In the next step we will summarise the data you have completed once again. Check them carefully and make sure they do not contain any errors - once the form is saved, editing the data will no longer be possible.

Once your details have been saved, your droplet becomes active for a period of 30 days and you can now make payments to it. In order to be able to also make withdrawals and keep your donations active permanently, it is still necessary to make a verification transfer and to send the relevant documents.

How do I make a verification transfer?

A verification transfer involves sending the amount of PLN 1 from your company/organisation's bank account to the individual account number of the dropshot you set up earlier. You can make it in two ways - with a standard or instant verification transfer.

All the data you need to make a standard verification transfer, you will find in the "verification" tab. Simply copy them and order the transfer on your bank's website. The bank account from which you make the verification transfer will later be the only one to which you can withdraw the collected funds.

Please note that the details given below are only an example. Each user has individual data for making a verification transfer - you will find them in the "verification" tab.

Remember! The name of the sender of the transfer must be identical to the data of the company/organisation which was provided earlier in the form (to be checked in the "Your saved data" tab). If these details do not match, the verification will be rejected.

The standard verification transfer must be a regular, traditional transfer made through the website of your bank based in Poland - the verification payment cannot be made from abroad, through external payment gateways or through the 'deposit' button on the dropbox page.

You can also choose a faster and easier option - an instant verification transfer. All you have to do is select the appropriate bank from the list, log in to your banking and order the transfer, and your account will be verified even in a few minutes! Please note - this option is only available for selected banks.

How do I attach documents to verify my profile?

The final verification step is to attach the relevant verification documents. Here again, there will be a difference - depending on what type of business you do, the system will ask you to attach the relevant documents. You can find a detailed breakdown of the required documents here.

The data from the uploaded documents must match the data indicated in the identification form and verification transfer. Please also ensure that the photos you attach are of good quality and that all edges of the document are visible.

We will proceed to check the verification documents as soon as the verification transfer is credited to your dropbox account. You will be notified by email in case of any deficiencies. Once the attached files are accepted by our Security Department, your account will already be indefinitely active and the possibility to withdraw the collected funds will be unlocked.

Check also - how to verify a private account?

When verifying a company profile, it is always necessary to send scans or photos of the identity document of the person managing the profile on zrzutka.pl.

Below is a list of the other documents necessary in the verification process, depending on the type of business:

Foundation

- KRS excerpt

- A scan of the foundation's statute

- Document confirming the power to act on behalf of the foundation (if the managing person does not have the right to represent the foundation independently)

- Printout of an entry from the Central Register of Beneficiaries of the Actual Beneficiary

Sole trader

- Printout of an entry from the excerpt from CEIDG

Registered association

- KRS (National Court Register) extract

- A scan of the association's statutes

- Document confirming the rightto act on behalf of the association (if the managing person does not have the right to represent the association independently)

- Printout of an entry from the Central Register of Actual Beneficiaries

Ordinary association

- A scan of the association's by-laws together with a resolution on the appointment of a representative or of the management board

- A document confirming the power to act on behalf of the association

- Confirmation of NIP (Tax Identification Number)

Limited Liability Company / General Partnership / Joint Stock Company

- Extract from the National Court Register

- Document confirming thepower to act onbehalf of the company (if the managing person does not have the right to represent the company on its own)

- A printout of an entry from the Central Register of Real Beneficiaries

Civil partnership

- Scan of the civil partnership agreement

- Document confirming the right to act on behalf of the company (if the managing person does not have the right to represent the company on its own)

Limited partnership / limited joint-stock partnership

- Extract from the National Court Register

- Document confirming the right toact onbehalf of the company (if the managing person does not have the right to represent the company on its own)

- A printout of the entry from the Central Register of Beneficiaries of the Real Property

- Information corresponding to a current excerpt from the Register of Entrepreneurs of a limited liability company which is the general partner of a limited joint-stock partnership (not older than 3 days).

Partnership

- Extract from the National Court Register

- Document confirming the authority to act on behalf of the company (if the managing person does not have the right to represent the company individually)

Simple joint-stock company

- KRS excerpt

- Document confirming the right toact onbehalf of the company (if the managing person does not have the right to represent the company on its own)

- A printout of the entry from the Central Register of Beneficial Owners

Scans or photos of current documents should be attached under "Account verification" after logging in to your profile.

Drop-off management

Each airdrop set up on our portal receives its own individual bank account number to which you can make a donation. You can find the account number of your airdrop in the "My airdrops" tab or by selecting the "Ordinary transfer" option among the available airdrop donation methods.

An individual bank account number is created for each drop. You will pay out the funds collected to the bank account with which you have verified your organiser account.

You can read how to do verification here.

There are no charges for the individual bank account of the drop.

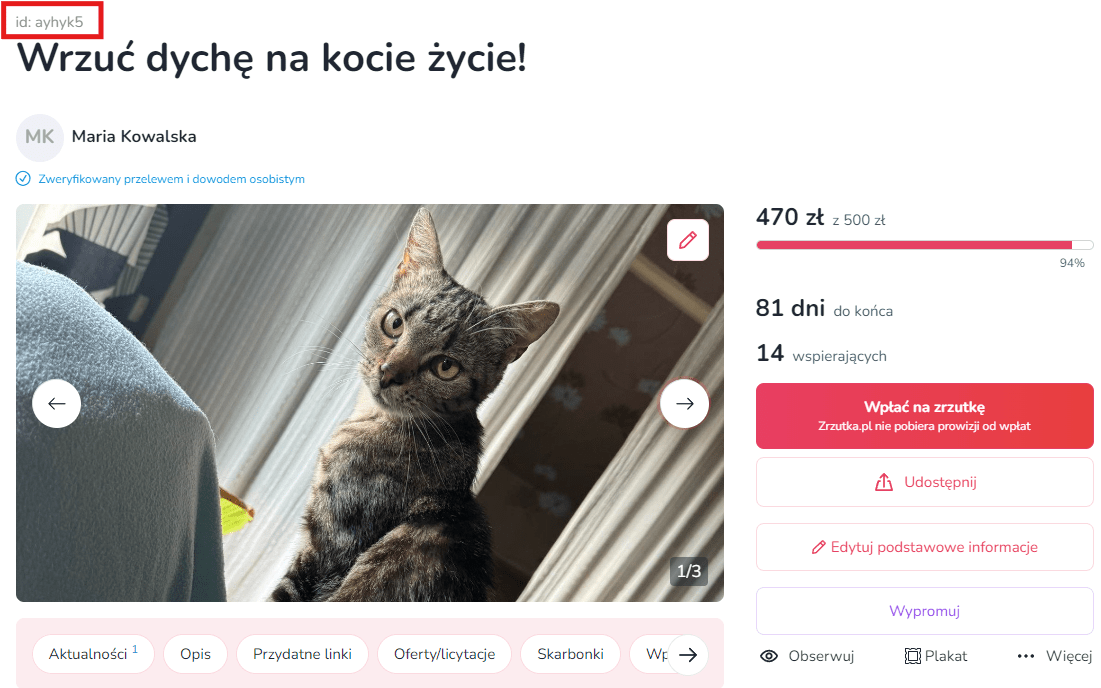

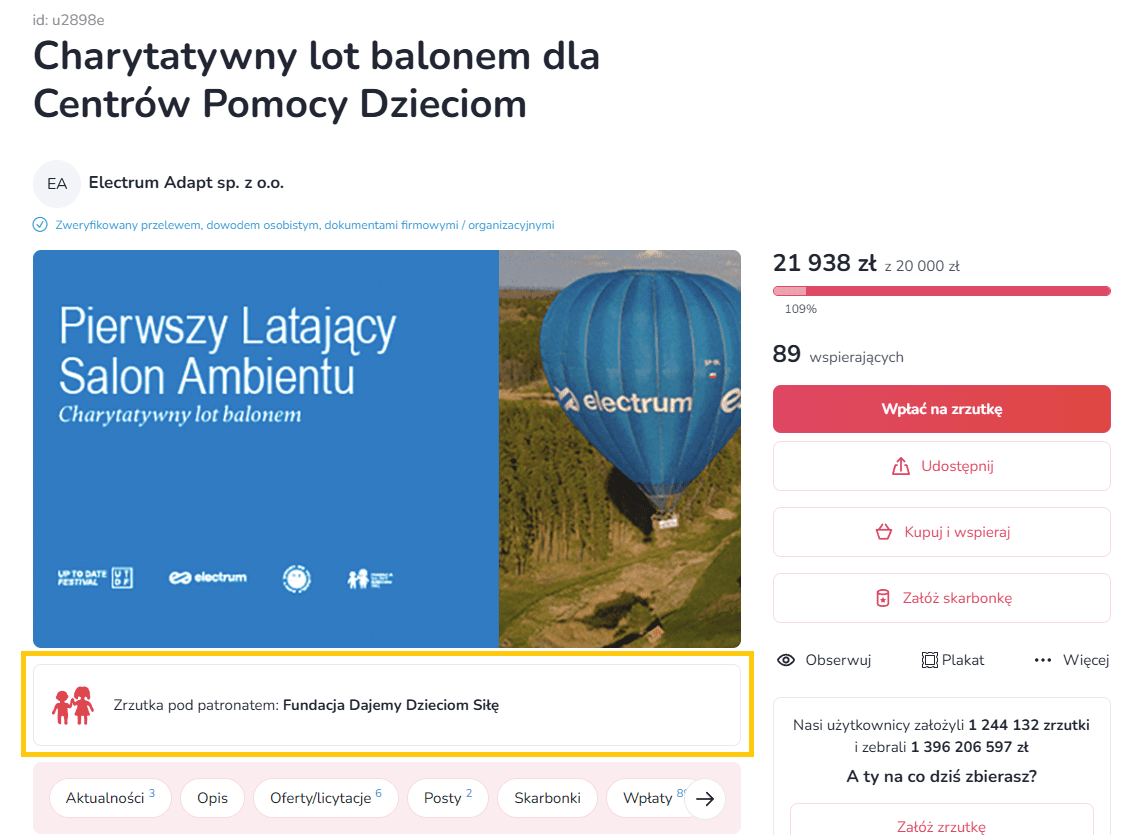

Every airdrop set up on our portal receives its own individual ID number, i.e. a unique string of six characters. You will always find the ID number just above the droplet's title.

If you want to add your first news item, this functionality can be found just below the dropdown description box, just behind the useful links. Once you have added your first content, the news box will automatically move above the dropdown description. To add news, click "+".

The news edit view is analogous to the droplet description edit view. The information added here will be displayed above the droplet description. Importantly - this section remains editable even after you have verified the airdrop, which is when you can no longer change the description itself.

Once you have finished editing, click "Add update" to save the changes.

Like any user, you can also add your comments, replies to other comments and reactions with emoticons. As an organiser, you also have the additional function of deleting comments that you consider unwanted.

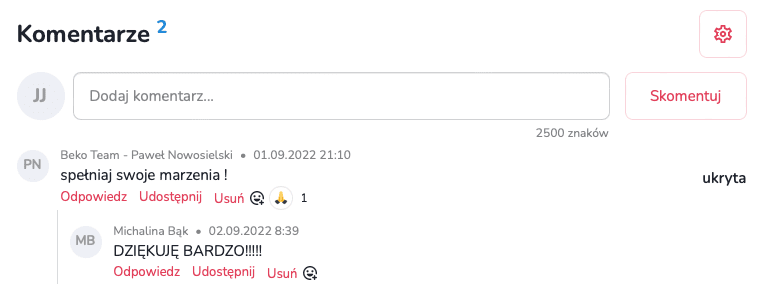

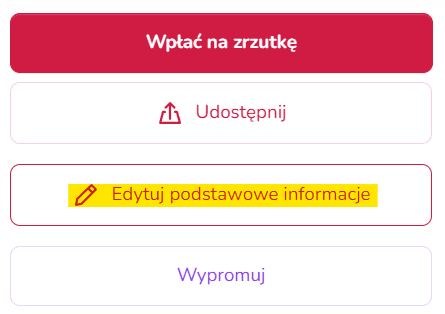

In addition, you can decide whether you want commenting on your dropbox to be possible at all, and if so, whether for everyone or only for contributors. You can find the comment settings by clicking on the cogwheel icon in the 'Comments' section at the bottom of the dropdown view.

Contributor details (even for anonymous and unregistered donors) can be viewed by generating a contribution summary ("My Drops" -> "...More" -> "Finances" -> "Download as XLS").

The donation summary contains a complete list of donors to a given droplet, together with the donor's details, the donation amounts, the payment method, the email address given at the time of donation and other data (if available).

Additional features

We thought you could please your donors and give them a thank-you note for the donation received. You can create your personalised version of the thank you note and set its content in the edit dropdown. You will do this in the "Edit basic information" tab on your dropbox page (remember to save the changes you make) - find out more.

We have collected all the advanced features of zrzutka.pl for you in this post. Enjoy your reading!

If you would like to create your own tracking link that shows you click statistics, press the "...More" button on the selected dropdown and select the "Create link with statistics" option:

Select and enter your own tracking address or click the "Randomise" button to generate a random string:

Now simply click the "Save" button and your own link will appear:

To check the statistics of your address, add a "+" sign at the end (e.g. zrzutka.pl/z/moj-link-tracking+).

You can find out more about the tracking link on our blog: https: //zrzutka.pl/blog/55/stworz-swoj-wlasny-link-do-promocji-zrzutki-i-sprawdzaj-na-biezaco-statystyki

A piggy bank works like an online collection box for a selected drop - employees of one company, fans of one celebrity or people in one Facebook group can transfer donations to it and see how much money they have raised together. The person setting up the piggy bank is seen as the organiser of the piggy bank and can edit the description, link and thank you for the donation, with the funds collected into the piggy bank credited to the balance of the main drop.

The piggy bank section is located in the dropdown view under the posts for bids/auctions. The ability to create piggy banks for your droplet is enabled by default. You can disable this option in the settings of the piggy bank section by clicking on the cogwheel and saving the selected option.

You can also create a piggy bank yourself by clicking on "Create piggy bank".

If you want to know more about piggy banks, take a peek at our blog.

You generate a poster for the dropbox in its view by clicking on the "Poster" option in the section on the right:

For more information on how to automatically create posters, click here: https://zrzutka.pl/blog/237/zaawansowane-funkcje-zrzutka-pl-jak-z-nich-korzystac

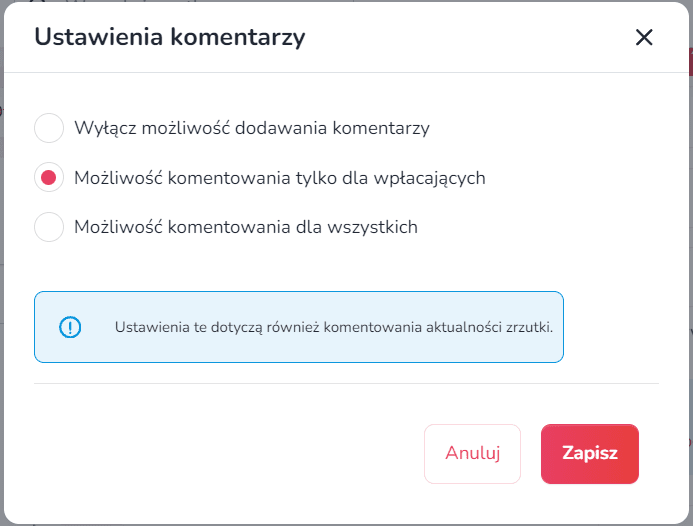

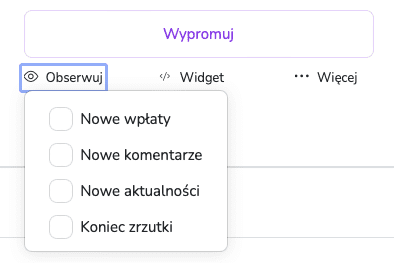

You generate the widget in the dropdown view by clicking on the "...More" button and selecting the "Create widget" option:

In the next window you can select the information you want the wigdet to display:

Now all you have to do is copy the widget code and paste it into the code of your page.

You can generate a QR code for each drop-off. Just take a picture to go to its details or directly to donate. You can use the QR on posters, flyers, presentations, billboards, or by showing it on your phone screen to your friends. You can forget about dictating the address of your drop - cycle and you're done!

See how easy it is:

Verification of the drop

In order to verify the description of the airdrop you can:

- use the tab 'Verify a droplet' available in your account settings on zrzutka.com or

- you can also verify your airdrop from the level of editing a chosen airdrop - in order to do so, log in to your profile and go to the very bottom of the airdrop's view, then upload the required documents using the field provided.

Important - you can read more about verification here.

Completion of the drop

You can change the end date of your airdrop at any time in editing your airdrop and this change does not entail any financial consequences.

To extend the duration of your airdrop, simply click on the "Edit basic information" button on your airdrop page.

And then enter the new end date of the droplet in the "End date" field and click "Save".

There are no financial consequences if the drop is discontinued.

To restore a snapshot, go to the 'My Snapshots' tab, then set the 'Disabled' filter and in the preview of the respective snapshot, click the 'Restore' button:

You can deactivate or completely delete your airdrop by going to the "My airdrops" tab. Next to the selected airdrop, press the "More" button, visible in the bottom left corner of the tile with the respective airdrop. Select 'Disable' or 'Delete' from the drop-down menu:

The deactivated airdrop will still be visible to visitors, but contributions to it will no longer be possible. A disabled airdrop can be reactivated at any time. Deleting a droplet will result in the visitor not being able to see its content. A deleted droplet cannot be reactivated.

Yes, the drop box can be deactivated by the organiser at any time.

The airdrop can be deactivated in the "My airdrops" tab. Next to the selected airdrop, press the "...More" button, visible in the bottom left corner of the respective airdrop's preview. Select "Disable" or "Delete" from the drop-down menu.

A disabled airdrop will still be visible to visitors, but donations to it will no longer be possible. A disabled airdrop can be reactivated at any time. Deleting a droplet will result in the visitor no longer being able to see its content. A deleted droplet cannot be reactivated.

For the organisers

The organiser does not incur any fees or commissions for organising the airdrop or for withdrawing the collected funds on zrzutka.pl

The contributor also does not incur any fees or commissions regardless of the payment method chosen.

We subsist on donations that you can voluntarily make when making a donation or withdrawal. You can read more about what happens to your donations to zrzutka.co.uk here.

All other costs (like promotion features) are outlined here. We do not have any other hidden fees :)

You do not have to pay tax on the funds raised if the contributions made by individuals in the last 5 years do not exceed PLN 5,733. In addition, you should refer to https://zrzutka.pl/blog/27/moje-zrzutki-a-urzad-skarbowy and https://zrzutka.pl/regulamin/.

Sending such documents is only necessary in exceptional cases. If the need arises - we will contact you.

Make sure you have a verified profile before making a return. To make a refund, go to 'My Dropdowns' and then press the 'More' button on the dropdown of your choice. From the menu that slides out, select 'Finances':

From the list of contributions, select the contributions you wish to return to your donors.

Once you have selected the selected contributions, press the "Return Selected" button at the bottom. A new window will appear where you select the party bearing the cost of the return. Return costs are described here.

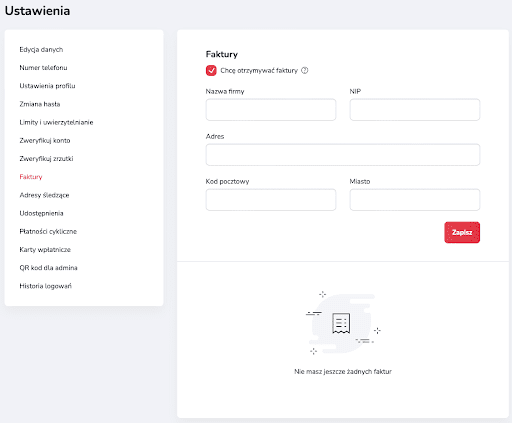

To receive invoices for premium features you have purchased, log into your profile, go to "Settings" -> "Invoices" and tick the "I want to receive invoices" checkbox.

Once you have filled in the form and saved it, each invoice for subsequent premium features purchased will automatically appear here.

We are not able to invoice retroactively (for services purchased before the checkbox was ticked). We also do not invoice for donations to the dropbox - if you would like to deduct your donation from tax, please see how to download a receipt for your donation and how to deduct your donation from tax.

All monies collected at the airdrop are at the disposal of the airdrop organiser.

If contributions made by individuals do not exceed PLN 5,733, no settlement with the Tax Office is required.

Read more about this topic: My Giving and the Tax Office

To receive invoices for premium features you have purchased, log into your profile, go to "Settings" -> "Invoices" and tick the "I want to receive invoices" checkbox.

Once you have filled in the form and saved it, each invoice for subsequent premium features purchased will automatically appear here.

We are not able to invoice retroactively (for services purchased before the checkbox was ticked). We also do not invoice for donations to the dropbox - if you would like to deduct your donation from tax, please see how to download a receipt for your donation and how to deduct your donation from tax.

Withdrawal of funds

The funds collected in the airdrops belong entirely to the organiser and can therefore be withdrawn at any time. To do this, go to the "Withdraw" tab. The system will ask you to enter an authentication code, sent to your email address or phone number.

Select the droplet from which you want to withdraw funds, enter the amount, as well as your withdrawal details. Finally, press the "Withdraw" button.

Done! The funds should post to your account within a maximum of two working days.

Remember, to be able to withdraw funds your profile must be verified - read how to verify yourself.

You can request a withdrawal at any time, even if the goal on your dropbox has not been reached. Please note that in order to make a withdrawal, the funds must first be verified.

Withdrawals can take up to two working days. Please note that withdrawals ordered on Friday after 4pm and on weekends and bank holidays are processed within the next two working days (that is, for example, on Monday, after the weekend).

However, if you want to receive your funds quickly, you can also use the express option (there is an additional fee). With this option, the collected amount will appear in your account within just a few minutes.

Read more about card withdrawals on our blog, an article dedicated to this solution can be found here.

No. The withdrawal will not reset the counter visible to visitors to the droplet. The amount paid out will only disappear from the balance available for withdrawal from your account on zrzutka.co.uk.

Payments on zrzutka.pl are made to a bank account assigned to the profile of the organiser ordering the payment. Assignment of an appropriate bank account takes place as a result of making a so-called verification transfer (more about verification here).

The blocking of withdrawals can occur essentially at three points:

If your payouts have been blocked for whatever reason, we will inform you via email what you need to do to unblock your payouts - so check your email carefully (including the SPAM folder).

For supporters

To donate to your chosen droplet, simply press the "Donate to droplet" button visible when you enter the droplet. The page will take you to a form where you need to select a payment method and also complete the basic information in the donation form.

In the case of ordinary transfers, the correctness of posting is guaranteed by the fact that each airdrop has an INDIVIDUAL bank account number.

NOTE: You can make a donation to the droplet from abroad - in order to do so, you need to select the "Traditional bank transfer" donation method and then use the IBAN and SWIFT numbers which will be provided in the last step of this donation method. You can also make an international deposit by paying by card.

'Online' contributions, handled by PayU, post to the drop boxes in up to 5 minutes.

Deposits by regular bank transfer can take up to 2 working days to post on the drop boxes and the posting of such deposits usually takes place between 11am and 7pm.

Once your deposit has been posted, you will receive a confirmation to the email you provided when you made your deposit. In addition to this, you can find your deposit in the "Deposits" tab visible on each droplet (unless the organiser has hidden the contributors' details).

You can download the confirmation after logging in to your user profile by going to the tabs: "My airdrops" - "Supported by me", and then in the preview of the respective droplet by selecting "Contributions" - "Download PDF confirmation" (as shown in the screenshots below).

.png)

.png)

What if you don't have a profile set up on our portal yet? Nothing lost! You can set up a profile at any time by clicking here - setting up an account is free and will only take you a moment, and once logged in you will have access to confirmations of all the donations you have made (even those made before you set up your profile). Just remember to enter the same email address you entered when you set up your profile.

Just remember to enter the same e-mail address you provided when setting up your profile as when making the donation.

You can check for yourself whether your donation has made it to the droplet by expanding the list of donations ("Donations" tab) on the droplet you supported:

If you don't see your donation listed here, please write to the droplet organiser to check if he or she has received your donation - you can do this by clicking on his or her name just above the photo of the droplet and then selecting "Ask the organiser a question". The organiser of the airdrop can check all the details of the donation in the donation list in their account on zrzutka.co.uk.

When making a donation, you can hide your details on the general contributor list. If you do not want your name to be visible on the dropdown page, simply tick the option "Hide my details in the general donation list on this dropdown".

You can also select additional options for your donation by expanding the 'Additional payment settings' section .

By all means! Contributions from abroad are most conveniently made by card payment or traditional bank transfer. Both of these payment methods are available on the dropbox page when you click the "deposit" button.

You can make a donation from abroad regardless of the currency (euro, dollar, etc.). Foreign contributions are automatically converted by your bank and will be credited to your account in Polish zloty.

We are committed to ensuring that the use of our portal remains free of charge, which is why we do not have the option to make contributions available via PayPal. We encourage you to use the other payment methods available - i.e. blik, Apple Pay, GPay, online transfers or card payments.

As zrzutka.co.uk, we do not have the possibility to undo a donation - the funds donated to the droplet become the property of its organiser. However, if you would like a refund, you can write to the organiser of the airdrop you have supported using the "ask the organiser a question" button to request a refund.

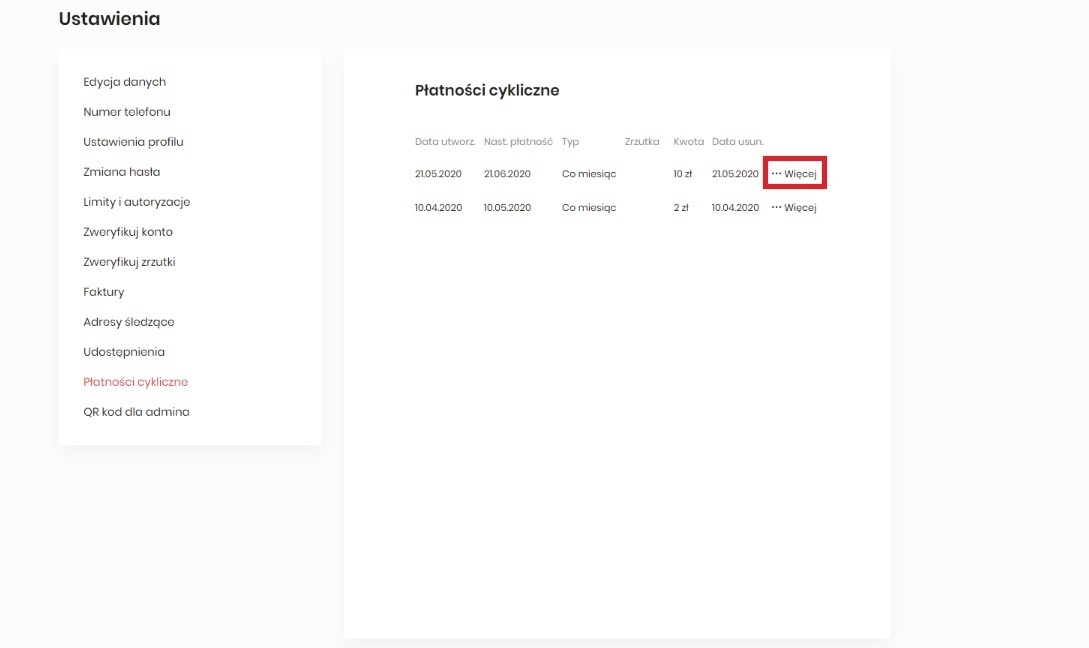

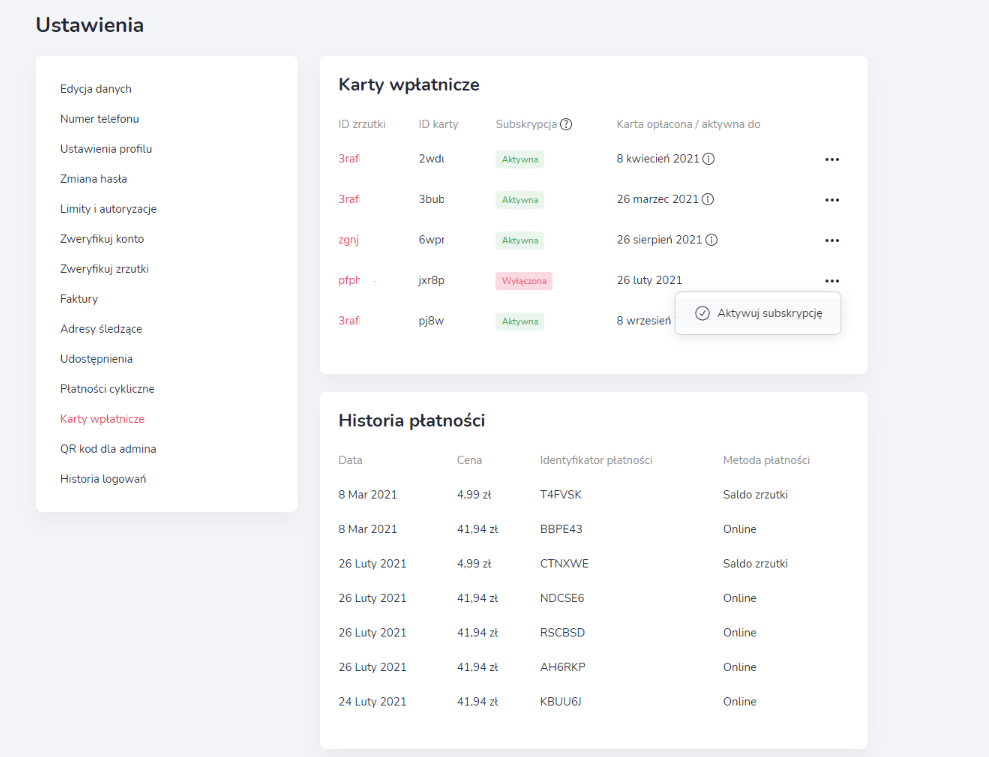

To change the card plugged into a recurring payment, go to the "Settings" tab and then select "Recurring payments" and "More":

Then select "Disable" and after disabling the payment - add it from scratch with the current card details, from the dropdown deposit view position.

If you have chosen an instant transfer handled by PayU, then all is well - your payment is processed by PayU in another bank account and transferred to the relevant dropbox based on the payment title you have specified.

A donation made on zrzutka.pl can be accounted for in the PIT depending on who was the organiser of the droplet to which the donation was made. You can read more on this subject here.

The possibility of deducting contributions in your tax return is presented in the following article: donations on zrzutka.pl a deduction in PIT. We also encourage you to register an account on our portal. In this case, you will be able to generate a confirmation of your donations on your own. You can obtain a confirmation of your donation to a droplet by generating a donation confirmation for a particular droplet. To do this, after logging into your account, go to "My airdrops" and then to the "Supported by me" tab. For a confirmation of your donation to a particular droplet, go to "Donation details" -> "Contribution details" -> "Download PDF confirmation".

Other

On the Zrzutka.pl platform, the offers and auctions function allows collection organisers and supporters to add items or services that can be purchased or auctioned. All funds raised go directly to the account of the designated airdrop, with no commission charged by the platform.

- "Buy Now" offers: Items or services available for immediate purchase at a fixed price.

- Auctions: Auctions in which users compete for an item by raising the bid. The highest bid placed before the end of the auction wins.

Items can be either physical (e.g. books, crafts) or digital (e.g. e-books, graphics). Symbolic bricks or thank-you notes are also available. After making a donation, the supporter receives access to the purchased content or a contact to collect the item.

Do you want to raise funds faster on your drop box? Or are you planning to organise a charity auction and need support? We have the perfect solution for you!

Now on Zrzutka.co.uk you can add vouchers, tickets, books, handicrafts and other physical or digital items or even symbolic bricks to your airdrop yourself. See how easy it is!

You will find the offer/auction section a little below the description of the droplet. To add an offer/auction, click on the "+" button:

In the edit window you can add a photo and description of the item, as well as the price and the category it belongs to. You will also choose whether it should be a "buy it now" offer or an auction. You will also be asked to specify how it is to be donated and to enter an expiry date - once this expires, the offer/auction will expire.

You can also add downloadable attachments as part of your prize - this is ideal for electronic prizes i.e. photos, vouchers, tickets etc. We will automatically send the link to download the attachments to buyers in the purchase confirmation email.

Once you have finished editing, click 'Save' to save your changes. To learn more about adding rewards, read our blog article.

Thanks to the new auction functionality, you can list and bid on items and services directly on the dropshots, and the money for your purchase will contribute to the purpose of the dropshot to which the auction has been added. And all this as usual - for free. No commission.

For anyone interested in the topic of bidding, we have added two detailed posts on our blog. Click to find out:

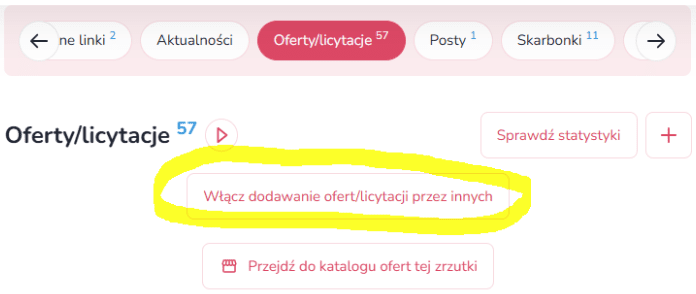

To enable the option for other backers to add bids/auctions to your droplet, in the Bids/auctions section, click the 'Enable others to add bids/auctions' button.

If your supporters add a bid/bid to your droplet, you will receive an email notification and you will be able to accept it when you log in to your droplet.

With the new bid/auction funders feature, you can support other people's airdrops by adding your bids/auctions to them, as well as receive support from others on your own airdrop! Watch the video or take a look at the comprehensive guide to adding bids/auctions and learn about the new possibilities, both from the point of view of the prize funder and the recipient.

If a bid or auction has not yet been purchased or if there are no bidders at the time of the auction, such a bid can be deleted.

However, if at least one bid has been purchased or the auction has at least one bidder, this is not possible.

In such a case the bid can be ended and the auction shortened. The bidding period may be shortened to a minimum of 24 hours before the end.

To shorten the duration of the auction, please contact zrzutka.pl customer service.

Shortening the duration of the bidding should only be used in exceptional situations, and the duration after shortening the bidding should not be less than 24 hours until the end, due to the email notifications that are then sent to the people participating in the bidding.

According to the terms and conditions, there is a 24-hour period to pay for the bidding, but the payment link is active until the exhibitor decides to cancel the bidding after this time or to give the next highest bidder in a row during the bidding period.

According to the regulations, the person who raises a bid is obliged to pay it after winning.

If for some reason you are unable to pay your winning bid, the auctioneer has the right to cancel it or give the next highest bidder the chance to pay - in which case your winning bid will be forfeited.

In repeated cases of non-payment, zrzutka.pl staff may take action to block the user of the site.

If you have not received your purchased item through a bid/auction, you can contact the exhibitor to resolve the situation by correspondence - usually a refund is then made. If the situation cannot be resolved in this way, you can apply to the zrzutka.pl staff for access to the exhibitor's sensitive data in order to take legal action.

If the bidder does not pay the winning bid within 24 hours after the end of the auction, you can contact the buyer.

You will find the details of all buyers under "My bids/auctions" -> "Listings" -> "Sold auctions awaiting payment".

You can contact the buyer by email and ask about the reason for the delayed payment. However, if the situation cannot be resolved, as the auctioneer we have three options after clicking "Report":

- You can cancel the auction without selecting a winner. You can then re-issue such a bidding process.

- You can pass on the opportunity to pay the winning bid to the person with the next highest bid in a row. Simply confirm your selection and all email notifications to the next winner will be sent automatically

- If the notification concerns another matter, you can write a message to the service department.

With posts, you can provide specific informationto people who have supported your droplet (by selecting a particular offer/auction) - for example: access codes or links to your content - e.g. photos or videos, access to the training courses you run, passwords to the premium content you offer and more. Posts are assigned to the bids/auctions in question - you must add at least one bid/auction to your dropbox for the ability to add posts to be active. Read more about posts to bids/auctions - posts to bids/auctions on zrzutka.co.uk

Other

We are committed to the highest safety standards. Find out more at https://zrzutka.pl/bezpieczenstwo/.

Zrzutka.pl, acting as a National Payment Institution, is obliged to verify its customers.

Once you have set up your airdrop, it is necessary to complete the identification form found in the "Account Verification" tab. Once completed, the acceptance of contributions to your droplet will be active for 30 days. During this time, it is necessary to verify the data provided in the form by bank transfer and to send scans/photos of documents confirming your identity.

Thanks to these procedures, we know exactly who is collecting money on zrzutka.pl and we can take care of the right level of security.

Zrzutka.pl verifies the identity of all Organisers. In addition, in situations defined by our regulations (for example, when the fundraising thresholds are exceeded or when we receive applications for a particular droplet), we also verify the truthfulness of the purpose indicated in the description of the droplet, asking the Organizer to send us the relevant documents. In case we have doubts whether the funds from an ongoing or already completed droplet have been used in accordance with the Organiser's declarations, we can also check how they have been spent by asking, for example, for transfer receipts, invoices or receipts. If you have any doubts or concerns about a particular collection, please contact the Organiser to confirm its reliability. You can also make a submission to the Dropbox, which will be analysed by our staff.

For more information about verification on Zrzutka.co.uk, please visit: https://zrzutka.pl/blog/262/jak-wyglada-weryfikacja-na-zrzutka-pl

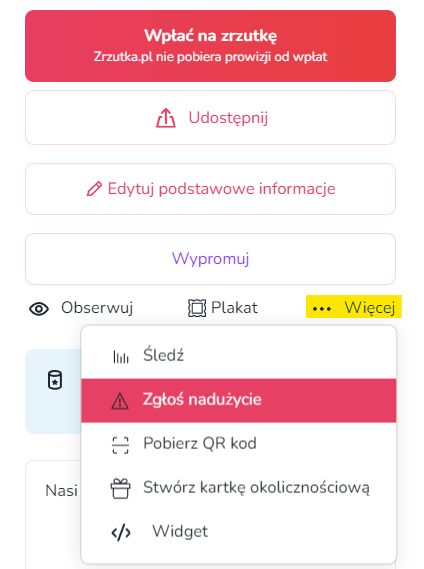

If you spot a suspicious airdrop on our portal - which looks like a scam, you suspect someone might be impersonating someone else, or the purpose of the airdrop is illegal, be sure to report it to us using the "report abuse" button. All such reports are analysed by our staff. It has happened more than once that it was this way that we obtained the first information leading to the detection of fraud attempts on our portal, which we always report to the relevant law enforcement authorities.

Find out what situations need to be reported - when to report a suspicious airdrop

To report the abuse of a particular droplet, simply click on "...More" -> "Report abuse" (you must be logged in to perform this action):

Then complete the content of the report, enter the phone number and agree to the processing of the data and click on the "Report abuse" button:

Finally, simply validate the information you have entered:

Each organiser's profile on zrzutka.co.uk shows how the profile has been verified. The profile can be shown as unverified or verified only by a transfer. The most reliable profiles are those verified by both a verification transfer and the organisation's identity card/documents. If you want to know more - read this article.

One of the basic points of the airdrop.co.uk terms and conditions is that it is forbidden to conduct airdrops for an illegal purpose. But what exactly does this mean? In this article, we have decided to cite some of the most common situations in which users of our portal tried to set up airdrops for a purpose that was prohibited by the current law - read the article.

This article is dedicated to the safe use of zrzutka.pl. Find out that using zrzutka.pl safely is not difficult at all - in this article you will find everything you need!

Yes. As of 18 July 2014, online account collections do not fall under the Public Collections Act. You can find out more from: https://zrzutka.pl/blog/8/nowe-moliwoci-zbierania-pienidzy-od-18-vii-2014.

The user may, at any time, block the installation of cookies, delete permanent cookies or otherwise modify the conditions for storing or receiving cookies, using the relevant options of their Internet browser, e.g:

Other

Persons over the age of 13 can run the drop-off. However, in this case it will be necessary to send a signed consent from a parent/legal guardian and a photo/scan of their identity document to verify the account .

At the outset, it is worth noting that the change can only be made to another account of the same person/entity.

Providing an account number for withdrawals is an extremely important step in the process of using the Zrzutka.pl platform. It is a key element in ensuring the security of the funds collected. Therefore, while maintaining special security measures, the process of changing your withdrawal account number is only possible by making a transfer from your new bank account. This procedure is necessary to ensure that the change is made by the account holder and not a third party.

To change the withdrawal account number assigned to your profile:

- Contact us using the contact form to inform us that you have started the process of changing your withdrawal account number.

- Make a simple, traditional bank transfer for the amount of PLN 1 in the title writing "change of verification" from your new bank account with which you want to verify your profile. The individual account number to which you need to transfer your disbursement can be found under "My disbursements".

- Important! The new account should be set up with the same personal details as the old account. Remember that the verification change transfer should be made from an account maintained by a bank based in the Republic of Poland.

- When the transfer is credited to your dropbox bank account, send us a message with a confirmation of the transfer and a request to change your account number.

We are aware that the change process can be time-consuming, but we assure you that we are taking care of your safety and the security of the funds collected in this way.

If you have any questions or concerns, we are here to help you. Contact us via the contact us tab and our specialists will be happy to assist you.

According to our regulations, it is not possible to change the organiser to another person or organisation.

It is also not possible to change the organiser's data - the data must be consistent with the data from the form, verification transfer and identity document.

However, in exceptional cases (e.g. change of surname) it is possible to correct profile data - please contact our customer service department for this.

To change your email address, please make a simple traditional bank transfer from your currently verified bank account (in the amount of £1), to your dropbox. In the title of the transfer, please write "change email to ..."- in place of the dots, please write your new email address (unregistered on zrzutka.pl). When the transfer is credited to your airdrop, please let us know, along with a link to your airdrop. We will make a change of address.

The individual bank account number of the airdrop can be found by going to "My airdrops".

When logging in, use the "I don't remember my password" option. Then click on the link you will receive in your email inbox. The link will redirect you to a form on zrzutka.co.uk where you will need to enter your new account password.

Make sure that the email that arrived in your inbox was sent from the address [email protected].